3Q25 Market Insights | Beyond the Numbers

Markets rose despite mixed economic signals. Stocks posted gains in Q2, with stocks climbing on the back of strong corporate earnings, resilient consumer spending, and ongoing enthusiasm around AI-related investments.

Author

Chris McCall

- Markets continued to climb in the 3rd quarter. Global equities registered solid gains buoyed by strong corporate earnings and enthusiasm around Artificial Intelligence (AI). Technology and AI themes remain major tailwinds. Investment in generative AI, automation and technology infrastructure is driving both revenue growth and longer-term productivity hopes across sectors even amidst uncertain macro conditions.

- Inflation remains a focal point. In the U.S., the Consumer Price Index (CPI) rose 2.9% year-over-year in August, up from 2.7% in July. Consumer inflation expectations climbed to 3.4% for the year ahead. While inflation has eased from recent highs, pressures and expectations remain elevated.

- Interest rate and bond dynamics continue to evolve. With inflation surprisingly sticky, and the Federal Reserve (the Fed) hinting at more rate cuts, bond markets are showing strength. Some areas such as municipals are still dealing with supply-demand pressures.

- Research Highlight: With a mixed backdrop, risk navigation remains essential. The economy is showing signs of both resilience (steady consumer spending and strong AI spending) and softening (job market, manufacturing, and industrial production weakness). Meanwhile, geopolitical tensions, tariff developments, and data delays from the recent U.S. government shutdown add further uncertainty. Valuations, particularly among U.S. large and mega cap technology names, remain elevated with high expectations. Leaning toward undervalued areas such as international and small cap stocks while maintaining exposure to enduring growth themes like AI and technology may help balance risk and opportunity. This is a time for steady hands, not heroics.

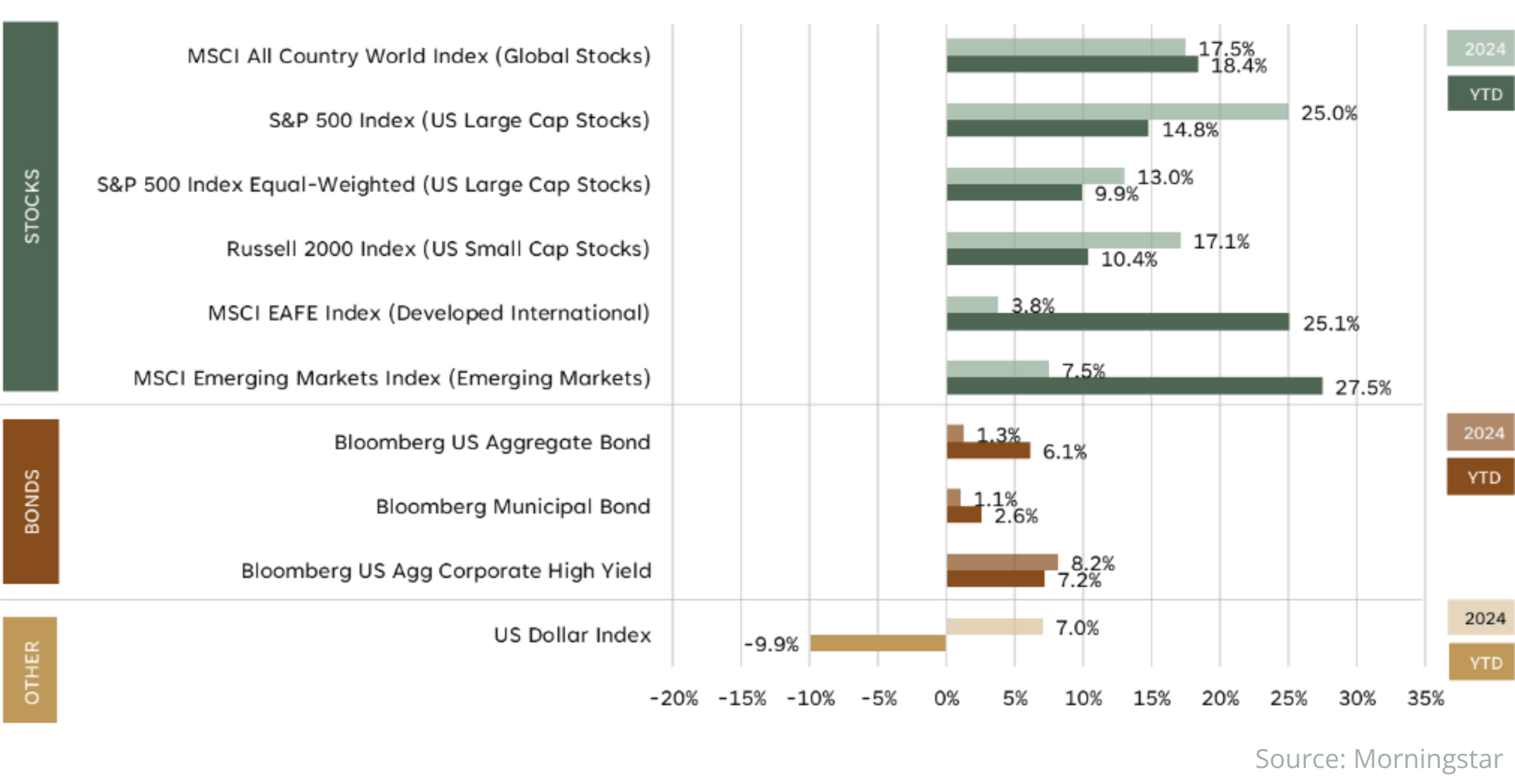

2025 Market Performance (Through 9/30/2025)

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the SEC. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.