4Q24 Market Insights | Beyond the Numbers

by Allison Daines

Author

Chris McCall

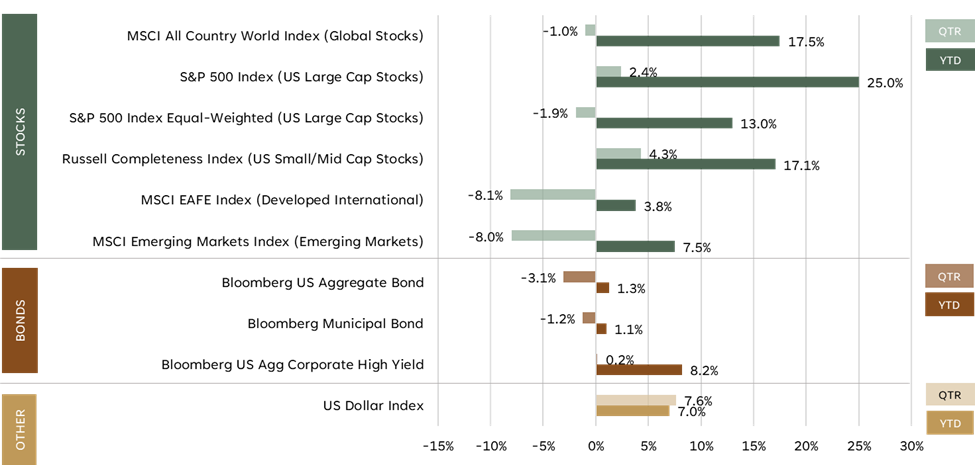

- Major market indexes had mixed results in the fourth quarter as the US dollar surged 7.6%, inflation concerns resurfaced (slightly), and bond yields rose. Nonetheless, stocks showed strong gains for the year—most notably within the United States. International stocks lagged for the year, mostly due to foreign currencies declining relative to the US dollar.

- The S&P 500 Index finished the year trading at 21.5 times expected 2025 earnings. While this is above the 30-year average of 17, the weighting to technology stocks is higher than it’s ever been. These companies historically command a higher valuation. US small/mid cap and international companies have much more reasonable valuations and may have an easier time exceeding expectations going forward. Dividend-paying stocks also have reasonable valuations.

- Bonds ended the year with a 1% gain as inflation eased to around 3%, though it remains persistent. High-yield bonds stood out, delivering an impressive 8.2% return due to strong demand for yield and their shorter-term nature. Unlike government and investment-grade debt, high-yield bonds are less affected by inflation and more influenced by corporate fundamentals.

- Research Highlight: Looking ahead to 2025

. Global central banks are likely to cut interest rates and support economic growth. There is robust capital investment in artificial intelligence, power and energy, security, and robotics. Markets know this, which is why we’re seeing elevated valuations—especially in US large cap companies. We expect volatility and more modest returns as markets and economies normalize. Ultimately, we’re dedicated to strategic diversification to navigate market fluctuations and drive long-term growth.

2024 Market Performance (Through 12/31/2024)