2025 Market Review & 2026 Outlook | Beyond the Numbers

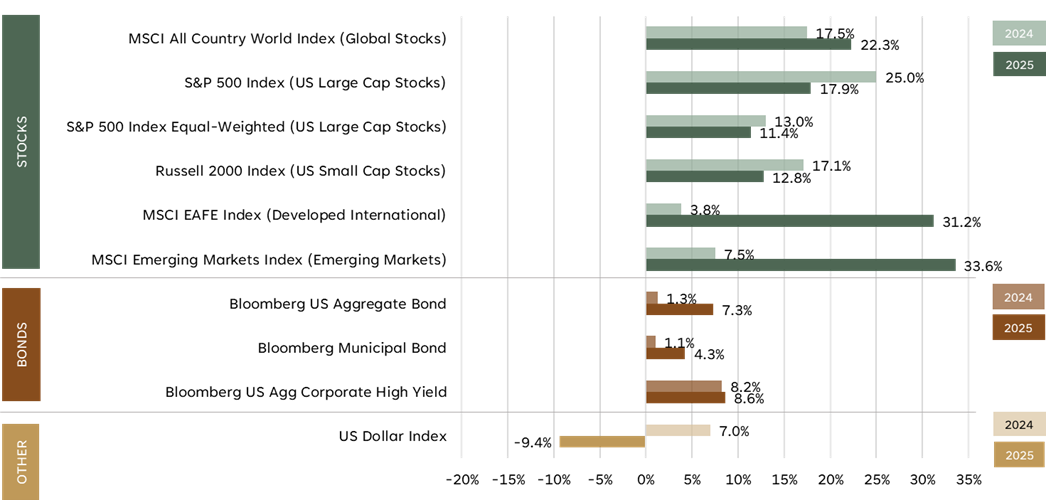

Markets rose despite mixed economic signals. Stocks posted gains in Q2, with stocks climbing on the back of strong corporate earnings, resilient consumer spending, and ongoing enthusiasm around AI-related investments.

Author

Chris McCall

Executive Summary (For the Skimmers)

- 2025 was a strong year for markets, driven largely by excitement around artificial intelligence.

- 2026 is likely to feel different - less exuberant, more selective, yet broader participation.

- AI is real and important, but not every AI-related investment will live up to expectations.

- Market leadership has been concentrated, and some valuations look rich.

- Inflation and labor trends point to cooling, not collapse.

- Healthcare and real estate stand out as lagging areas with long-term potential.

- Short-term bumps are likely, but long-term progress remains intact for disciplined investors.

2025 Market Performance (Through 12/31/2025)

Strong Results, Shifting Questions

Looking back on 2025, it’s hard to argue with the results. Markets climbed to new highs, confidence was strong, and enthusiasm around artificial intelligence (AI) dominated headlines. After an early-year stumble that bottomed in March, investors largely felt the wind at their backs for much of the year.

The excitement hasn’t disappeared, but investors are asking more practical questions about sustainability, valuation, and risk. That’s a healthy development. Periods like this tend to reward discipline more than enthusiasm.

AI: Transformational, But Not Automatic

AI is unquestionably reshaping how companies operate. Productivity gains, automation, and new business models are real, and AI-related investment last year played an outsized role in both economic growth and market performance.

The challenge heading into 2026 is less about whether AI matters and more about timing and expectations. Capital spending on AI infrastructure has surged, more recently funded with debt or vendor financing, while profitability for some is being questioned.

This doesn’t mean AI is a bubble waiting to burst. It does mean investors are likely to become more selective, distinguishing between durable business models and projects that rely heavily on optimistic assumptions. Importantly, we’re also moving toward the application phase of AI, where productivity gains spread gradually across nearly every industry, not just technology companies. This could be a positive development for other industries and companies that have lagged the technology sector.

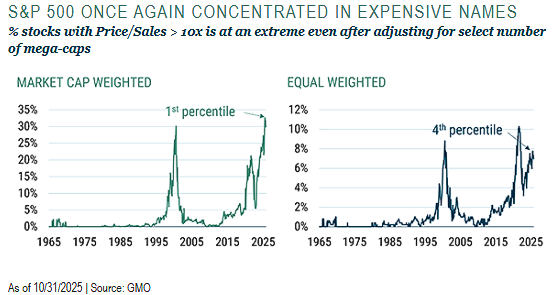

Valuations and Narrow Leadership

One reason caution feels appropriate today is valuation. A meaningful share of U.S. market capitalization trades at elevated multiples, driven largely by a narrow group of mega-cap technology companies. These are high-quality businesses, but markets become more fragile when leadership narrows and expectations rise too far, too fast.

History reminds us that even great companies can disappoint when priced for perfection. This doesn’t guarantee a major downturn, but it does suggest that future returns may be more uneven and more dependent on fundamentals than enthusiasm.

Inflation: Still Present, Less Threatening

Inflation remains part of the backdrop heading into 2026, but its character continues to evolve. Most companies appear focused on protecting margins through expense management rather than passing along aggressive price increases.

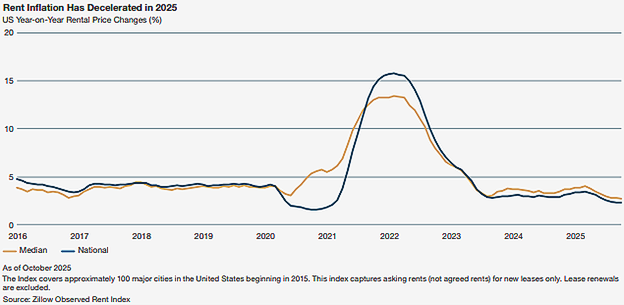

One encouraging development is housing. Rent growth has cooled meaningfully, and this historically feeds into broader inflation measures with a lag. If that trend persists, it could help offset upward pressure from tariffs and input costs.

Inflation may prove stickier than many hope, but it also appears less likely to re-accelerate meaningfully from here.

The Labor Market: Cooling, Not Cracking

The U.S. labor market softened in the second half of 2025, with job growth slowing well below historical averages. At the same time, unemployment rose only modestly.

A key factor has been labor supply. Labor force participation among immigrants declined meaningfully, reducing the number of new jobs needed to keep unemployment stable. This dynamic may limit sharp increases in unemployment.

The takeaway is balance, not alarm. The economy appears to be cooling rather than collapsing. This is a backdrop that calls for realistic expectations rather than extremes of optimism or fear.

Healthcare: Value in an Overlooked Corner

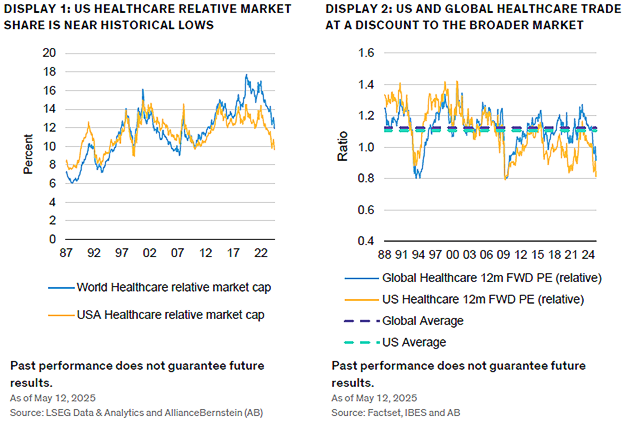

One area we find particularly interesting is healthcare. Healthcare valuations sit near multi-year lows relative to the broader market, despite steady demand and improving fundamentals.

Unlike many sectors tied closely to economic cycles, healthcare benefits from long-term structural drivers: aging populations, ongoing innovation, and persistent demand for better outcomes and efficiency.

Recent underperformance appears driven by temporary headwinds, including political uncertainty, higher interest rates, and shifting investor preferences. As those pressures fade, healthcare offers the potential for both earnings growth and valuation expansion.

We’re especially drawn to areas focused on tangible improvements in care such as diagnostics, medical technology, life-science tools, and innovative therapies that deliver real value to patients and to the companies that develop them.

Real Estate: Selectivity Matters

Real estate is another area that has lagged recent market performance and now looks more attractive from a valuation standpoint.

Public real estate securities, primarily REITs, have underperformed broader equities and currently trade at discounts relative to their own history. Many assets are supported by durable income streams and long-term leases, with sectors such as industrial space, senior housing, and logistics benefiting from secular demand drivers.

While challenges remain, the early data suggest that a patient and selective approach may uncover opportunities where valuations are misaligned with long-term income and growth potential. This is an area we are still researching.

Looking Ahead with Perspective

We expect 2026 to bring more volatility, more differentiation between winners and losers, and fewer “easy” returns driven by broad valuation expansion. At the same time, economic growth continues, innovation continues, and opportunities continue to emerge. We also expect broader market participation from other areas of the market.

Short-term bumps are inevitable. What matters most is staying oriented, keeping expectations realistic, and focusing on fundamentals that endure. With patience and a long-term mindset, we remain optimistic about the road ahead, even if it isn’t perfectly smooth.

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the SEC. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.