1Q25 Market Insights | Beyond the Numbers

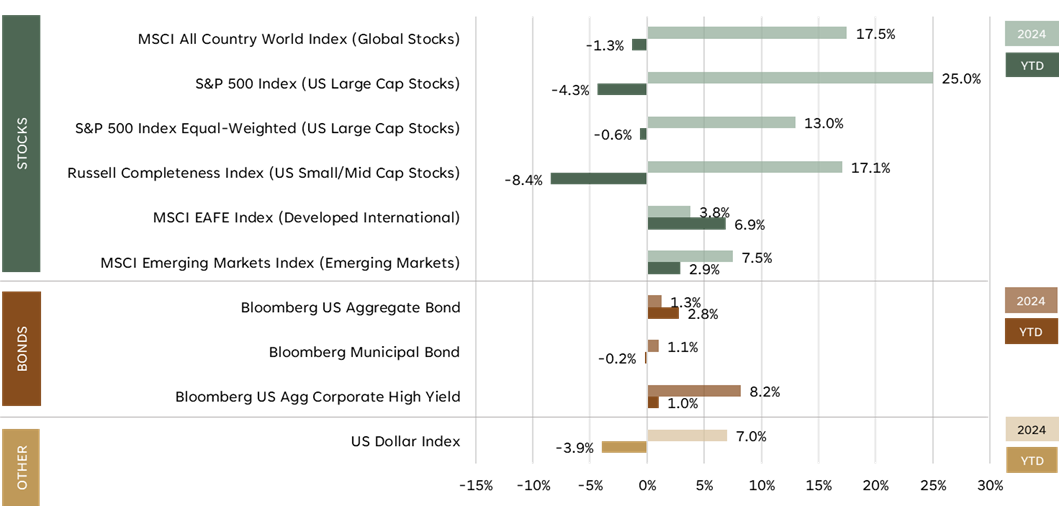

- Markets started strong but lost momentum due to tariff and trade concerns. The U.S. dollar fell 3.9%, and inflation worries resurfaced as investors weighed the potential impact of tariffs on supply chains and consumer prices.

- International stocks outperformed U.S. markets, boosted by stronger foreign currencies and fewer trade-related headwinds compared to U.S. companies. Regions like Europe and parts of Asia benefited from improved economic data, more stable inflation trends, and rising optimism around intra-regional trade. For U.S. investors, the combination of local market strength and a weakening dollar provided a tailwind to international returns.

- Bonds acted as a stabilizer, helping cushion portfolios against stock market volatility during the quarter. Investors were reminded of the important role bonds play in a diversified portfolio.

- Research Highlight: Opportunity Abroad. U.S. stocks have dominated for the past 15 years, but the landscape may be shifting in favor of international markets. As global trade patterns evolve and countries consider deepening ties outside the U.S., international companies could see new growth opportunities. A potential weakening U.S. dollar may further boost foreign stock returns for American investors, making the case for global diversification more compelling.

2025 Market Performance (Through 3/31/2025)

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the SEC. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.