2Q25 Market Insights | Beyond the Numbers

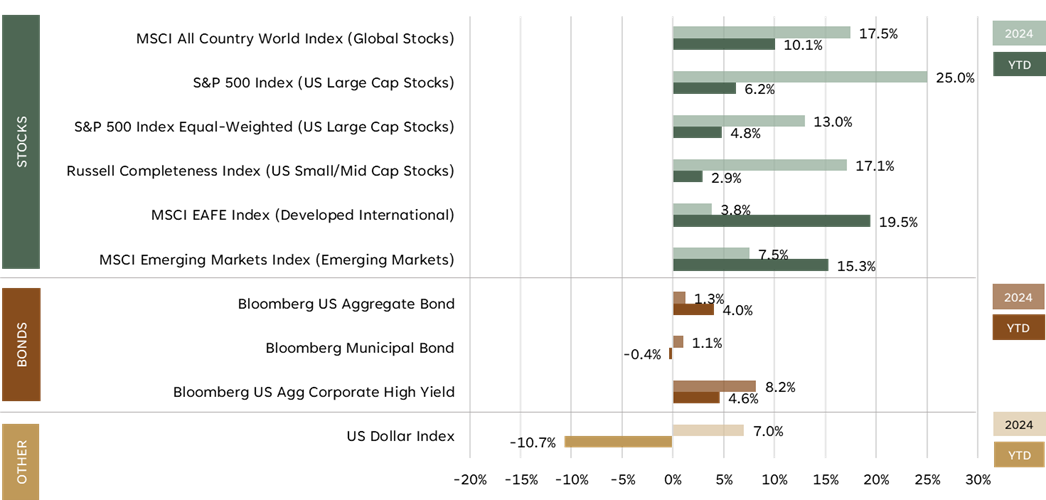

Markets rose despite mixed economic signals. Stocks posted gains in Q2, with stocks climbing on the back of strong corporate earnings, resilient consumer spending, and ongoing enthusiasm around AI-related investments.

Author

Chris McCall

- Markets rose despite mixed economic signals. Stocks posted gains in Q2, with stocks climbing on the back of strong corporate earnings, resilient consumer spending, and ongoing enthusiasm around AI-related investments.

- Inflation has moderated but remains in focus. Inflation data as measured by CPI (Consumer Price Index) has eased to around 2.4% year-over-year, although Core CPI remains stubbornly above the Fed’s 2% target at around 2.8%. Some investors remain cautious that inflation could reaccelerate later in the year as the full effects of recently announced tariffs work through supply chains and consumer prices.

- Bonds showed strength as inflation concerns continue to ease. The exception is municipal bonds, which have seen a surge of new issuance this year—creating a supply/demand imbalance in the short-term.

- Research Highlight: Valuation Gaps Suggest Opportunity Abroad and Down the Cap Spectrum.

While U.S. large-cap stocks—especially mega-cap tech—have dominated in recent years, they trade at historically elevated valuations. In contrast, international stocks and U.S. small caps remain meaningfully discounted, both relative to their own history and to U.S. large caps. Over the long run, valuation tends to revert to historical norms. As global economic growth broadens and market leadership rotates, these undervalued areas may offer better long-term return potential and enhance portfolio diversification.

2025 Market Performance (Through 6/30/2025)

Journey Beyond Wealth (“JBW”) is an Investment Advisor registered with the SEC. All views, expressions, and opinions included in this communication are subject to change. Registration of an investment advisor does not imply a certain level of skill or training. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy, or the completeness of, any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication's conclusions. Past performance does not guarantee future performance. Future returns may be lower or higher. Investments involve risk. Investment values will fluctuate with market conditions, and security positions, when sold, may be worth less or more than their original cost. Please contact us if there is any change in your financial situation, needs, goals or objectives, or if you wish to initiate any restrictions on the management of the account or modify existing restrictions.